Description

The team carried out a review of existing private sector financed initiatives – excluding corporate social responsibility (CSR) CSR projects – identifying key stakeholders for consultation. Our research also reviewed a range of existing private sector initiatives and investments which aim to improve food security.

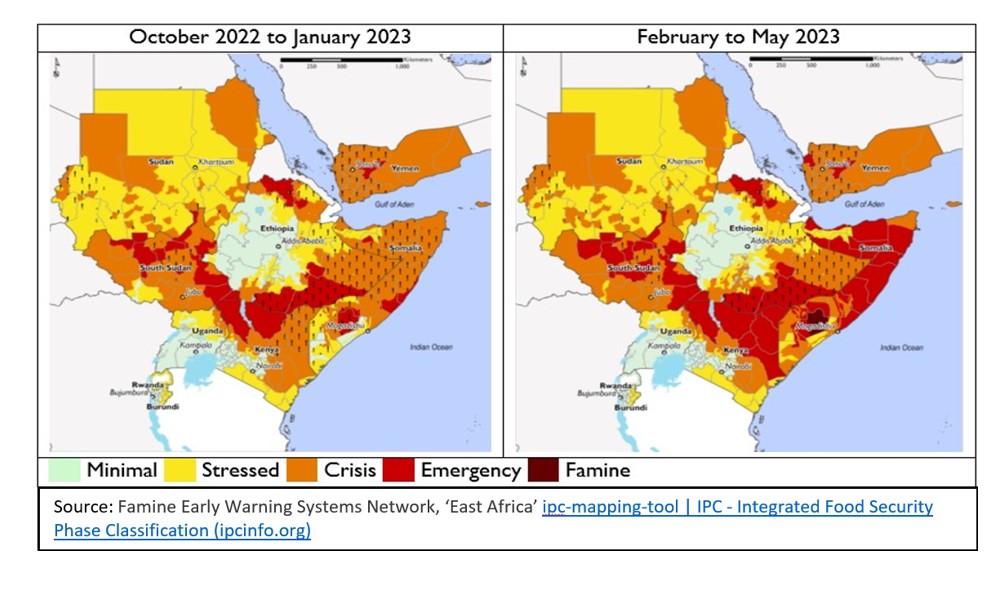

We found that, where that private sector financing has a role to play in building the resilience of medium-term food systems to prevent future emergencies, but that it is not suitable for addressing short-term, urgent financing needs related to acute food insecurity that is at crisis levels or near to them. Further, private sector investors need significant de-risking in countries that are most affected by acute food insecurity, as well as policy predictability and demonstrated national commitments to domestic and regional food and agriculture strategies, indicating that substantial additional donor and public sector intervention is needed to catalyse investment and to direct it towards investments that will have the biggest impact on food security.

Our suggestions to FCDO emphasised two objectives which need to be prioritised to maximise impact:

1. 𝗙𝗼𝗰𝘂𝘀 𝗲𝗳𝗳𝗼𝗿𝘁𝘀 𝗼𝗻 𝗰𝗮𝘁𝗮𝗹𝘆𝘀𝗶𝗻𝗴 𝗽𝗿𝗶𝘃𝗮𝘁𝗲 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗶𝗻 𝗹𝗼𝗰𝗮𝗹 𝗮𝗴𝗿𝗶𝗰𝘂𝗹𝘁𝘂𝗿𝗮𝗹 𝗽𝗿𝗼𝗰𝗲𝘀𝘀𝗶𝗻𝗴 𝗮𝗻𝗱 𝘃𝗮𝗹𝘂𝗲 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻. The missing value chain link in many acutely food-insecure countries is local processing and value addition capacity, which would also provide local offtake for domestic agricultural production. Many initiatives to date have not focused on this piece of the equation, but rather on access to inputs and smallholder farmer support.

2. 𝗟𝗲𝘃𝗲𝗿𝗮𝗴𝗲 𝗯𝗹𝗲𝗻𝗱𝗲𝗱 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗻𝗴 𝘁𝗼 𝗺𝗼𝗯𝗶𝗹𝗶𝘇𝗲 𝗹𝗼𝗰𝗮𝗹 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗶𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 𝗹𝗲𝗻𝗱𝗶𝗻𝗴 𝘁𝗼 𝗽𝗿𝗼𝗰𝗲𝘀𝘀𝗶𝗻𝗴 𝗮𝗻𝗱 𝘃𝗮𝗹𝘂𝗲 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻 𝗦𝗠𝗘𝘀. Local currency lending is often the type of financing that agricultural SMEs most need: SME financing needs are not well-matched with the types of foreign currency investment that development finance institutions (DFIs) and other international investors offer, especially with regard to ticket size and return expectations.