Case study

More than half (57%) of workers in Africa work in agriculture and 80% of rural people rely on agriculture as their main income source.

Finance is critical for moving nations up the economic ladder. Yet despite agriculture’s importance in Africa, limited investment is being made in the sector. Where most transformational, such financing has often been concessional (i.e. it doesn‘t fully price for risk).

Aims of the project

Gatsby wanted to understand the potential for development finance to transform sectors in Africa and the role this could play in achieving the SDGs, with a special focus on agriculture.

What we did

We looked at sectors that have been successfully transformed to assess the role finance played, alongside other key factors. We considered the extent that different types of finance are available for agriculture, given its importance to achieving the SDGs. And we presented ideas to increase the types of finance needed to support agricultural sector transformation in Africa.

Key insights

The agriculture sector receives limited investment: commercial banks tend to be unwilling/unable to provide loans; only 1–2% of DFI portfolios go to agriculture while 6% of impact investors’ assets under management do; there are few sovereign wealth funds in Africa, and their exposure to agriculture is low. Hence actors avoid agriculture because of risks and modest return potential even though it’s central to poor people’s jobs and livelihoods

We found that DFIs and other financial providers had played key roles in providing ‘concessional finance’ in our case study sectors. So there is potential for such finance to support sector transformation – but there are risks. Much of this investment did not achieve nor seek risk-adjusted returns, and rather sought to build capability, show success and crowd in other players.

DFIs were set up to take on the high risks of pioneering. This role has now changed, with the private sector taking more of the risk and DFIs entering later with risk/return requirements similar to commercial capital. This leaves a gap in the supply of concessional finance needed to support high-impact sector transformation, though new and interesting models and initiatives are emerging at the fringes.

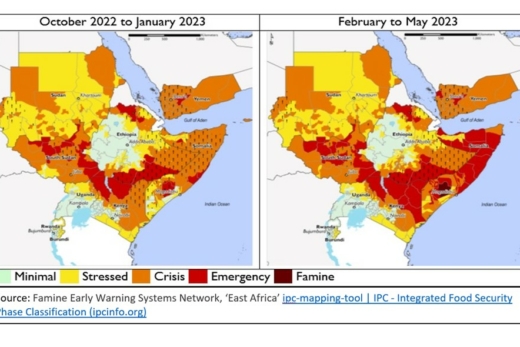

Agriculture is central to achieving the SDGs. Economic growth in the sector is believed to be up to 11 times as effective at reducing poverty as growth in other sectors. Yet it will always be risky to finance, with marginal (or even negative) returns common for new enterprises.

Agricultural sectors across Africa appear to be starting to transform, with small commercial and medium-sized farms making up a growing share of farm holdings. These can be a force for dynamism, technological change and wider commercialisation, but they need access to concessional finance to do so.

Our case studies show that sector transformation requires supportive industrial policy and sector-level support. And finance often needs to be linked to mechanisms that enable firms to access appropriate and affordable technologies and skills training.

There are signs of movement back towards more flexible risk capital such as CDC’s Catalyst Funds. This could provide scope for extending more innovative risk capital back into agriculture.

Further research is needed into what development impact targets should be in place and the most effective options for providing concessional finance to agriculture.