Case study

Concessional finance has become an increasingly important tool in enterprise development over the last decade, and there has been a huge amount of innovation and investment, especially in underdeveloped financial markets in sub-Saharan Africa and South Asia.

To understand whether these interventions are providing the expected development impacts and to know which financing tools and institutions are most effective for different types of farmer and or food systems, we carried out a Rapid Evidence Assessment which combined key informant interviews and targeted literature searches of publicly available information, including academic papers, investor reports and other published documents that met a series of high-level search definitions.

Our aims were to answer the following questions:

- What is the evidence supporting the development impact of different forms of concessional finance to agribusinesses (e.g. DFIs, impact investment, challenge funds) with respect to job creation, better living conditions, access to nutritious foods and climate resilience?

- Where are the major evidence gaps?

We defined concessional finance as that which is offered on terms and/ or conditions that are more favourable than those normally available from the market, and considered a number of finance sources, including development finance institutions (DFIs), impact investors and challenge funds.

We found that the evidence base linking the provision of concessional finance to the achievement of development impact is limited.

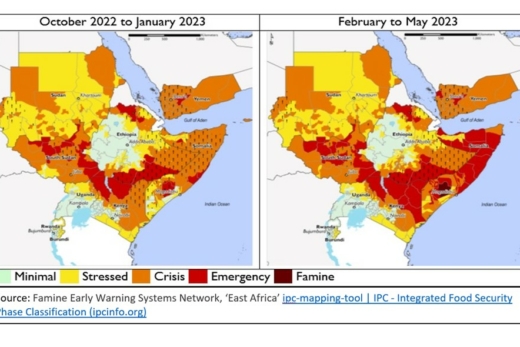

With regard to the types of development impact, we found that farmer productivity and farmer income were most common. When it came to jobs, nutrition and climate change, we found some but not substantive evidence of impact, as these were not analyzed sufficiently.

The evidence on the best types of concessional finance was also scarce, however impact investment, if done right, can strengthen links between farmers and commercial value chains and help to reduce side-selling. For development finance institutions, we found some evidence that long term capital is important to enable agribusinesses to grow. We also found some evidence that commercial banks’ investments in agriculture had delivered positive developmental impacts. Lastly, we reviewed challenge funds and again found some evidence that these had contributed towards the creation of decent work, supporting improved outcomes for smallholder farmers.

Download the report using the buttons below or see more evidence from the The Commercial Agriculture for Smallholders and Agribusiness (CASA) Programme here