Case study

Introduction

During August and September, Wellspring Development Capital and Sofala Partners conducted a “rapid diagnostic” on the impact of COVID-19 on agricultural finance in Uganda, on behalf of Financial Sector Deepening Uganda (FSDU). We consulted more than 85 experts and practitioners across the country, from those involved in farming and agro-processing, to traders and exporters, commercial banks, NBFIs, SACCOs, regulators, development partners, and more. We would like to express our sincere thanks to those who took the time to share insights with us.

In a fast-changing landscape for agricultural markets and financial flows, the highlights presented below cannot – should not – claim to be the last word. But we hope these findings prove useful to industry participants and development practitioners alike, provoking discussion and informing decision-making as Uganda bounces back robustly from the ‘lockdown economy’ by targeting agriculture as the key engine of job creation, value addition and export-led growth.

Snapshot: Uganda’s agriculture sector pre-COVID-19

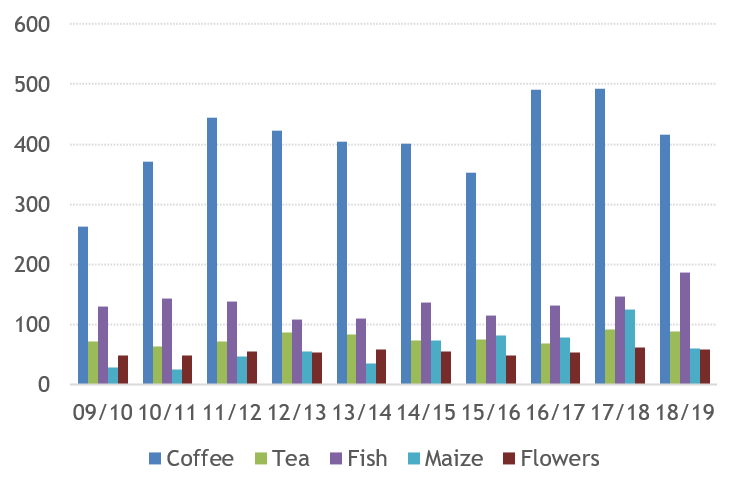

Let’s start with a framing question: which structural trends defined Uganda’s agricultural markets pre-COVID? As many readers will know, Uganda is broadly self-sufficient in terms of domestic food availability and agriculture is a key sector for the economy, contributing around 22% of GDP and 52% of the value of total exports.[1] Coffee is the largest export earner, making up 11% of total export earnings of goods, while other important exports are fish, tea, maize, flowers, cocoa, sugar, horticulture, and cotton.

Smallholders comprise the majority (85%) of Ugandan farmers; a further 12% are medium-scale farmers; while only 3% are ‘large-scale’.[2] As a result, agriculture is a source of livelihood for more than 70% of the country’s population. The main food crops in the domestic market are plantain, bananas, cassava, sweet potatoes, millet, maize, beans, sorghum, groundnuts, and sesame – a notably diverse mix.

Top five agricultural export earners (US$m)

Source: Bank of Uganda

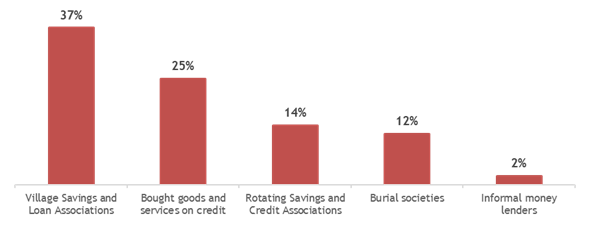

As elsewhere, structural impediments to financial access existed prior to COVID-19. Only ~6% of small-scale Ugandan agribusinesses had access to a loan or line of credit, versus 44.1% in Kenya.[3] Instead, Uganda’s agri-SMEs and smallholders have historically relied more on informal sources of credit, or their own cash, to fund activities. Tellingly, a Consultative Group to Assist the Poor (CGAP) national survey revealed that only 10% of smallholder farmers in Uganda have bank accounts.

Sources of informal credit

Source: FSD Uganda

Impact of COVID on market dynamics

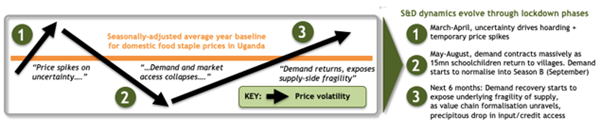

As the global pandemic gathered pace in Q1 2020, Uganda entered ‘lockdown’ in late March, with borders closing on 23 March. The subsequent re-opening has been phased, with public transport resuming on 2 June, borders reopening on 22 September, and a partial reopening of schools planned for 15 October. How has this period of unprecedented disruption affected agriculture? The one-line summary is that in food-surplus Uganda, COVID-19 created a crisis of oversupply amidst collapsing demand.

In March and April, the country saw an initial price spike for food products as uncertainty drove hoarding behaviour; subsequently, however, from May through to August, demand contracted sharply and prices fell. As one interviewee for our survey noted: “Food crops were available in abundance but there was low purchasing power, low consumption […] Demand for high-value foods also fell with the closure of hotels, and most food prices fell due to restricted consumption and loss of export market access […] there was a glut of perishable produce, food crops, milk, eggs, while demand for dry rations increased.”

Yet this supply glut proved temporary. Prices are now stabilising, and we expect a different – more heterogenous – narrative heading in Q4: a story of demand-side recovery in most domestic and regional food staples versus continued low demand in some export crops affected by weak global end-markets. As one survey respondent observed, “The price of local produce will be near stable and normal in the months to come as long as the supply of fuel, fertilizers, and other inputs stabilizes. Prices of maize, dry beans will go up as demand from South Sudan increases. Prices of perishables will not increase. However, earnings from cash crops such as coffee, tea and horticulture may decline in the coming months.”

Supply and demand dynamics pre and post lockdown

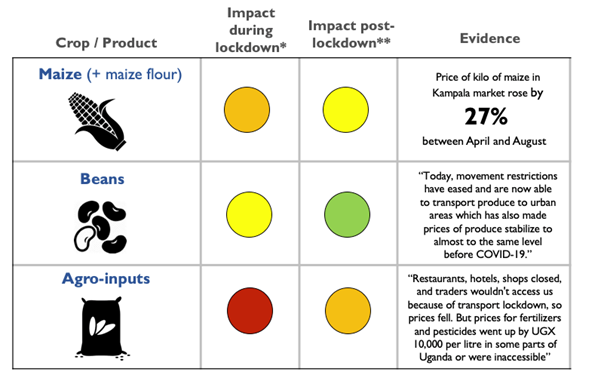

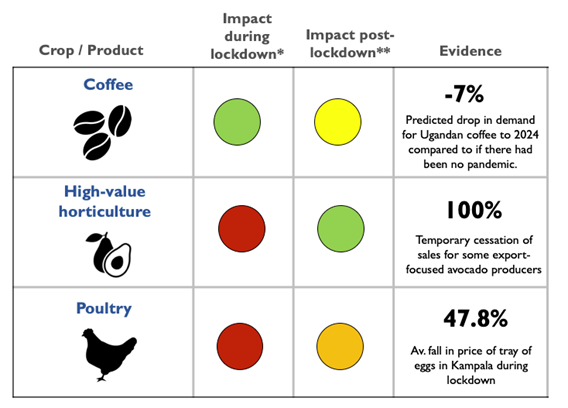

Deep dive: Value chain analysis

Some value chains were more affected than others by COVID-19 induced changes to demand and supply in Uganda. Poultry, for example, saw a particularly steep drop in demand in response to an almost total cessation of activity in the tourism and hospitality sectors. Agro-inputs were similarly affected, but for different reasons: this was due to a fall in supply as cross-border supply chains froze over. By contrast, coffee and tea were minimally affected during in the period between March and August, with export volumes exceeding previous highs. However, interviewees noted these sectors are likely to suffer a much longer ‘hangover’ from COVID-19, with low end-market demand for several years to come.

* Impact on farmer incomes during lockdown (March-May)

** Impact on farmer incomes post-lockdown (June – August)

COVID-19’s impact on lenders

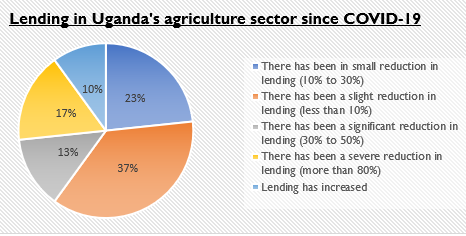

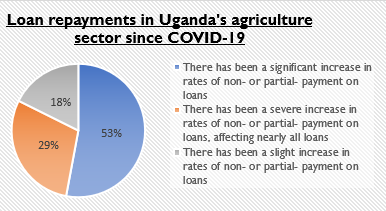

Unsurprisingly, COVID-19 has impacted not just agricultural markets but also the financial flows that underpin them. The impact varied widely, as this chart shows:

Source: FSD Uganda Survey August 2020. (n=30; respondents were lenders, producers and processers/traders)

Savings and Credit Cooperative Societies (SACCOs), Village Savings and Loans Associations (VSLAs) and Microfinance Institutions (MFIs), which together form the backbone of Uganda’s agricultural finance ecosystem, were worst affected by COVID-19, experiencing liquidity challenges due to reduced cash flows and accumulation of bad debt. Survey respondents associated with SACCOs and MFIs all noted that since March 2020 lines of agricultural credit had ‘significantly’ (30%-50%) or ‘severely’ (more than 80%) reduced. As a results, SMEs and smallholders – the largest client base for these local-level financial institutions – experienced the greatest reduction in access to capital.

Commercial banks, which prior to March 2020 provided 93% of formal lending by volume in the sector, have continued to lend, but at a slightly lower rate, and lending has – in large part – been restricted to existing borrowers. As one interviewee commented: “banks actually have a lot of liquidity currently […] but they are generally sitting back – playing wait and see for now”. Similarly, impact investors consulted for this study noted that rather than seeking to diligence new investees at a time when in-person meetings were challenging, they were channelling further resources into agri-businesses with which they had an existing commercial relationship predating COVID-19.

Anecdotally, it appears non- or partial- payment on loans have also increased.[4]

Source: FSD Uganda Survey August 2020. (n=17; all respondents were lenders)

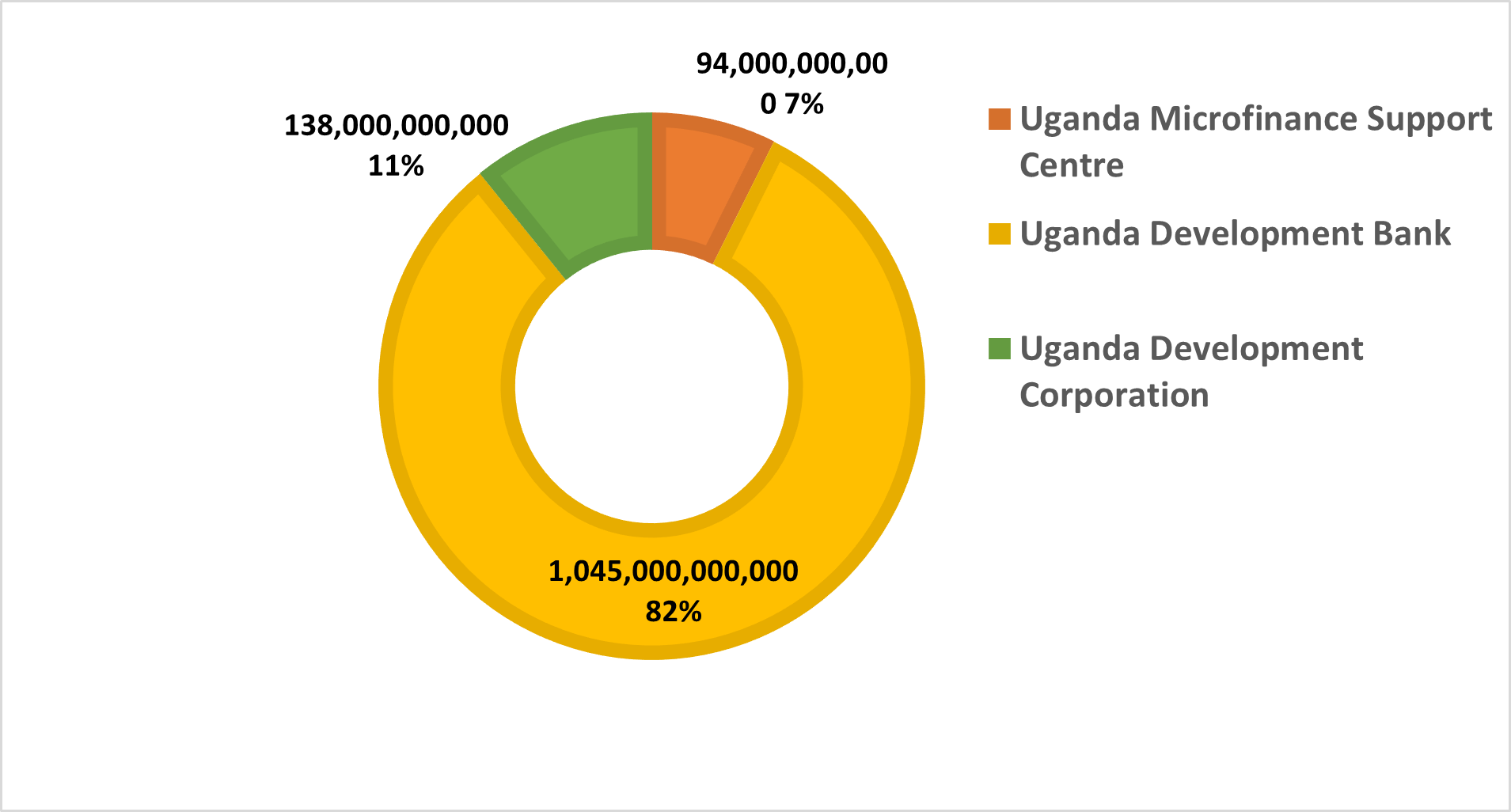

State lenders – Uganda has no Agriculture Development Bank or Cooperative Bank, so traditionally the state has been relatively uninvolved in direct agricultural lending. However, the government’s assertive plans to channel approximately UGX 1.277 trillion towards the recapitalization of Uganda Development Bank (UDB), Uganda Development Corporation (UDC) and MicroFinance Support Centre (MSC) buck this trend, placing the state centre stage in the COVID-19 economy recovery. We understand that the majority of resources are likely to be channelled through the UDB, which is focused on funding for larger, export-focused firms. Support for MSME’s will be channelled through MSC.

Ugandan government allocation for investment financing

Source: Initiative for Social and Economic Rights, May 2020, access here

Five key takeaways from on the-ground consultations

As this post demonstrates, no ‘one size fits all’ narrative is available to capture the impact of COVID-19 on Ugandan agriculture and agri-finance. Rather, a nuanced picture is emerging, demanding tailored and targeted responses. Different value chains will bounce back at different speeds, and the same applies to credit flows from different lender categories.

Nevertheless, our research did identify a few cross-cutting themes which may prove useful in guiding and informing decision-making in the months to come. We round off this post with a ‘top five’ summary:

- Input supply chains were badly affected during the lockdown

Supply chain disruptions (e.g. transport costs and implementation of expensive new SoPs) saw input suppliers operating expenses rise by 30-50%. In conjunction with reduced demand due to vendor closures and transport restrictions, which prevented farmers accessing seeds agrochemical shops, input suppliers reported that turnover fell by between 25% to 50% (some interviewees reported a 65% drop). There will likely be a delayed impact on production levels as key inputs weren’t available at the right time in Uganda’s bi-annual agronomic cycle. There was also a spike in the rate of counterfeiting of inputs, which reportedly already stood at ~40% for seed and 45% of agrochemicals, due to lower levels of in-person oversight and enforcement throughout lockdown.

2. SMEs were generally hit harder than larger agribusinesses

SMEs were affected by increased labour costs (as supply reduced) and a liquidity squeeze as SACCOs and VSLAs were impacted. In contrast the profits of some larger players – especially those that secured government contracts to distribute food relief – were broadly unaffected. As one respondent noted, “we need to create a level of competition in the market, with agri-SMEs empowered to act and properly financed. It doesn’t necessarily make sense [only] to back the big off-takers as they already have too much influence.” In particular, respondents cited SMEs’ need for working capital (see chart below): “SMEs have eaten up their capital, they urgently need to beef up liquidity to improve cash flow/trading cash.”

As noted above, the government is preparing a largescale MSME recovery fund (total stimulus package of ~UGX 5 trillion) to address this issue, to be financed both by donors and domestic borrowing. As part of this, with the aim of injecting liquidity into MSME sector, the GoU has allocated approximately UGX 94 billion ($25.5 million) to the MSC / Emyooga fund,[5] which will lend unsecured at 8% to SACCOS and 13% to MSMEs.[6]

3. Agri-export sector was also hit hard

Pre-COVID-19, a shipment from Mombasa to Kampala took roughly 3 to 5 days; in August 2020, it took ~20 days. Cost of freight/transport increased up by a third, while storage costs for stock also rose. The result is increased operational costs for agribusinesses. This logistics disruption, which continued as of October with 100km+ queues at the Malaba border post, has negatively affected 50% of businesses in Uganda, according to UN and GoU data. We have seen a particularly prominent impact on agri-exporters and traders in perishables, whose access to end-markets was choked off.

4. Non-COVID-19 issues exacerbated the negative impact of COVID-19

a) The lack of storage and grain handling infrastructure made the supply glut during Q2-Q3 worse. Uganda does not have a national strategic grain reserve; rather, storage is owned privately, with over 750,000MT country-wide (concentrated in Eastern and Central regions), of which and at least 70% is owned by members of The Grain Council of Uganda (large off-takers). Post-harvest loss reduction, especially drying facilities, could therefore form a central plank of the longer-term COVID-19 recovery strategy.

b) Lack of digitisation along the value chain exacerbated the firm-level economic effects of COVID-19. In particular the impact on aggregators, wholesalers and retailers exposed the weakness of an ‘analogue’ food system – panic buying and speculative trading in March led to sudden price spikes, especially in urban areas, but by April it was clear this was sentiment-driven and food prices fell as the extent of over-supply became clear. Digitizing agri-systems (e-extension, e-commerce, digital payments, and mobile-enabled market info) would reduce hoarding behaviour, price volatility, and producer uncertainty. Respondents therefore consistently highlighted that digitization initiatives could for part of an effective post-COVID-19 recovery strategy.

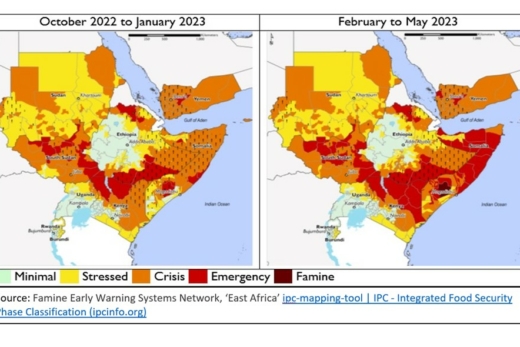

c) Crucial regional food market closed prior to COVID-19: Since January, Kenya has largely blocked Ugandan dairy imports, among other food commodities. Following the outbreak of COVID-19 this created a ‘treble blow’ for Ugandan dairy farmers (i) oversupply in the domestic market due to excessive precipitation; (ii) domestic demand shock due to the lockdown; and (iii) denial of access to Uganda’s largest export market, Kenya.[7] Hence, addressing non-tariff barriers to increased regional and continent-wide trade is a high priority issue, alongside any COVID-specific response efforts, if Uganda is to realize its latent potential as a leading cost-competitive food exporter to the region.

5. The impact on the loan books of commercial bank’s is not yet clear

The impact of COVID-19 on the rate of non-performing loans in Uganda will not become apparent until Q1 – Q2 2021. We must monitor this space closely. As one interviewee noted, “In response to COVID-19 the Bank of Uganda has eased regulation in the banking sector – whereas previously only two loan restructurings were permissible now it’s effectively uncapped – and banks are expected to be much more lenient [with borrowers] … the restructurings won’t show you the NPLs – we’ll need to wait till next year to know”.

[1] Food and Agriculture Organisation of the United Nations (FAO) – figures based on 2013/14 marketing year

[2] Farm Africa, www.farmafrica.org.uk/where-we-work/uganda

[3] Walker et al. 2018, “Developing the Agri-Food System for Inclusive Economic Growth: Uganda Economic Update no. 12”, Washington, DC: World Bank Group.

[4] Commercial banks report to the Bank of Uganda quarterly and there is then a delay in data publication. Hence, reliable bank-report data covering the full lockdown period is not yet available.

[5] The Emyooga fund is a presidential initiative focused on wealth and job creation through SACCOs that was launched in March 2020 and sees funds distributed to constituencies and qualifying SACCOs.

[6] Uganda’s Covid-19 economic stimulus package will it deliver, Initiative for Social and Economic Rights, May 2020, access here

[7] Kenyan and Tanzanian dairy farmers have cost of production of ~50 cents/litre vs 30 cents/litre in Uganda. Why? Inter alia, Ugandan cows grass-fed = lower feed costs