Case study

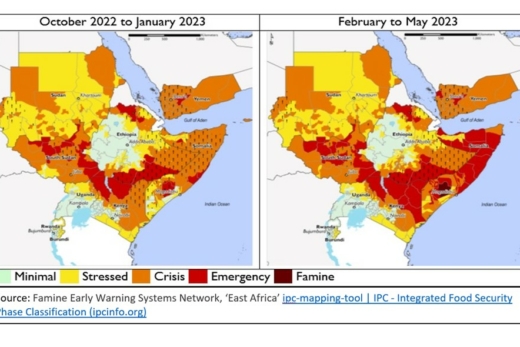

FTESA aimed to get more people in East and Southern African trading in regional staple food markets. Funded by UK Aid, it worked with the private sector and relevant institutions in nine countries to improve storage, inputs and service markets, information and coordination mechanisms, and policy and regulation.

Aims of the project

Wellspring worked alongside partners on a seven-month project to build on previous FTESA programme achievements and incorporate a strong active learning component focused on structured trade financing that benefits large offtakers, SMEs and producer organisations through aligning their interests.

‘Structured trade’ refers to the ways market actors organise trade relations, transactions, contracts and exchanges in commodity value chains.

Project aims were threefold:

- To work with large grain offtakers (i.e. buyers) to test new supply chain models that better align interests with smallholder suppliers

- To support the trial of a regional commodity auction to facilitate trade flows between businesses (buyers and sellers) across the region

- To run an embedded action-learning process to gain insights for companies, donors and implementors. This was designed to shed light on the potential for improvements in structured trade to benefit stakeholders in commodity value chains. It also aimed to show how interventions can better facilitate the sustainable uptake and spread of structured trade practices by market actors.

What we did

Wellspring co-developed and implemented agreements with five partners – four major offtakers and a regional commodity trade platform. We then worked alongside them, their banks and their SME grain aggregation suppliers to transition the SMEs from a trader intermediary model to different forms of commission agent model.

At the same time we worked with the regulators and banks to introduce different forms of warehouse receipt financing to enable offtakers to access more off-balance sheet finance. This meant they could increase working capital availability for SME aggregators and create options for smallholder producers to sell at different times of the year while still accessing cash at point of harvest using their receipts as collateral.

Alongside the Canopy Lab, we identifiedlessons, recommendations and insights for donors, implementors and companies.

Lessons for donors – on investments for catalysing the uptake and spread of structured trade strategies in East Africa

- Policy and political economy issues remain critical – being close to the largest buyers creates opportunities

- Take a portfolio approach: there will be failures, but the successes will be large scale

- Different value chains (e.g. cash crops vs grains) and different countries need different solutions

Lessons for implementors – intervention strategies and operational approaches for implementing donor investments

- Keep objectives simple and adapt tactics

- Select partners carefully: those with a proven track history and willingness to signal large offtake and to try new ‘farmer-aligned’ supply chain models

- Co-develop projects and proposals alongside the company

- Prioritise support to helping partners de-risk and integrate change

Lessons for companies – for East African off-takers who are thinking about structuring trade relations in their supply channels

- Ensure changes meet company needs and end-market opportunities

- Gain buy-in and support from senior management and board

- Use managers experienced in change management (or get support)

- Ensure you fully understand what is practically achievable within national warehouse receipt system regulations

Impact and results

Some of the highlights of supporting sales through local structured trading arrangements are as follows. Fifteen large agribusinesses from Malawi and Zambia participated in at least one of ACE’s maize or soya bean auctions. ACE also made US$5 million+ of bilateral deals with another US$22 million+ in a possible pipeline. AFGRI significantly increased project impact by implementing mobile phone applications. Raphael Group has rolled out MIS and cashless payment systems which have been well received. Across projects, the number of farmers selling grains directly almost doubled, reaching 27,500, and the value of payments to farmers increased by more than £300,000.